Immigration Targets Slashed by 50%: The Smart Employer's Guide to Workforce Planning in 2025

- jelizabetha

- Nov 11, 2025

- 5 min read

Canada just delivered a workforce planning wake-up call that every employer needs to understand. The federal government has implemented the most dramatic immigration cuts in recent history, fundamentally reshaping how businesses will find and retain talent in 2025 and beyond.

Here's what smart employers need to know: and do: right now.

The Numbers That Matter for Your Business

The cuts are substantial and immediate:

Provincial Nominee Program (PNP): Slashed by 50% across all provinces starting January 2025. If your recruitment strategy relied on PNP pathways, half those spots just disappeared.

Temporary Foreign Workers: Facing a 50% reduction in short-term admissions, directly impacting seasonal industries and skilled trades recruitment.

Temporary Residents Overall: Dropping by 43%: from 673,650 in 2025 down to 385,000 by 2026-2028. That's nearly 290,000 fewer potential employees entering Canada's talent pool annually.

International Students: Perhaps the most dramatic cut: falling from 305,000 to just 155,000 in 2026 (roughly half), then further declining to 150,000 in 2027-2028.

Permanent Residents: More stable but still constrained: 395,000 in 2025, declining to 380,000 in 2026 and 365,000 in 2027.

Why This Happened (And Why It Won't Reverse Soon)

The government cited three critical pressures driving these cuts:

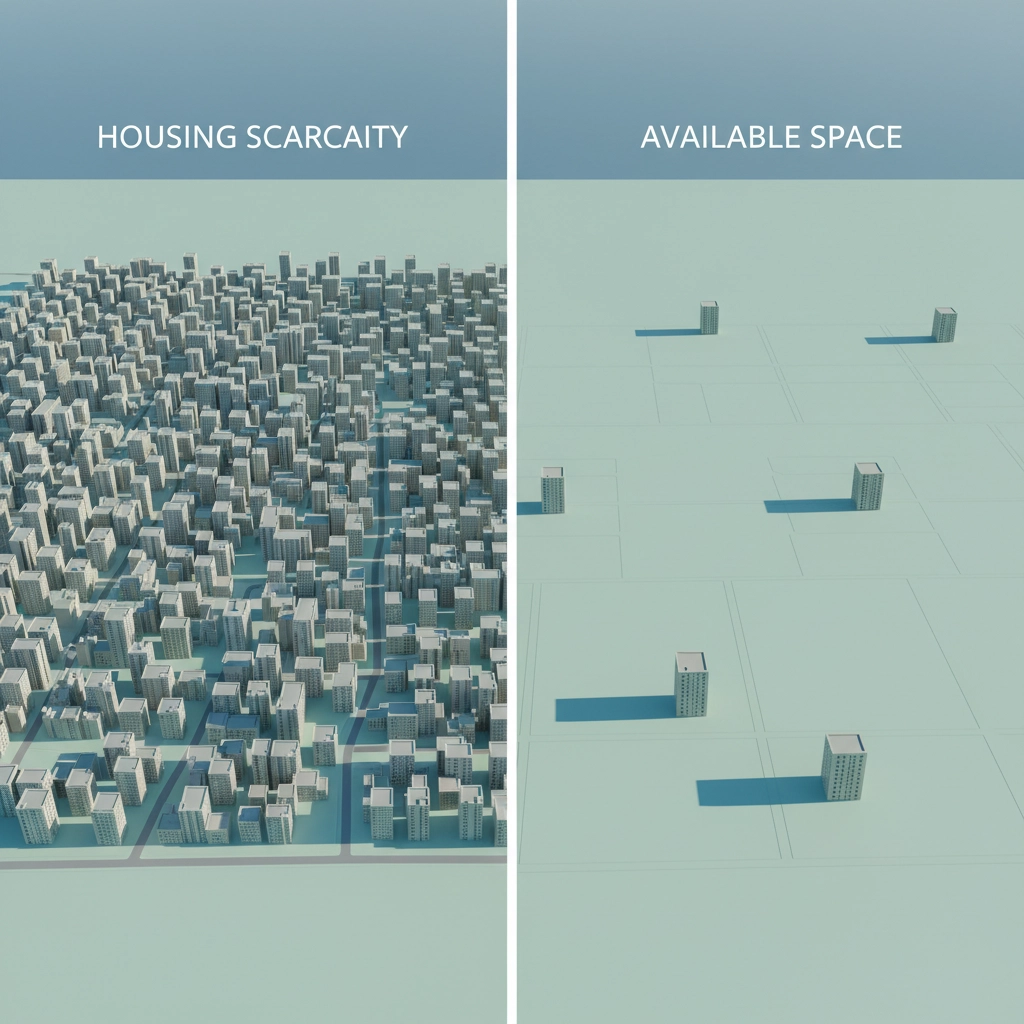

Housing Crisis: Canada's housing supply cannot meet current demand. Major cities are experiencing rental vacancy rates below 2%, with average rents rising 15-20% annually in Toronto, Vancouver, and Montreal.

Strained Infrastructure: Public services: schools, hospitals, transit systems: are operating beyond capacity. Provinces warned the federal government they couldn't maintain service quality without infrastructure investments that would take years to complete.

Labor Market Saturation: Despite unemployment sitting around 6.8% in mid-2025, certain sectors were experiencing both labor shortages and oversupply simultaneously, suggesting mismatched immigration streams.

The government's goal is clear: reduce Canada's population growth to 0.2% in 2025-2026, then gradually return to 0.8% growth by 2027. This represents a fundamental shift from the rapid growth strategy of 2023-2024.

How Each Immigration Stream Affects Your Hiring Strategy

Provincial Nominee Program Impact

With PNP allocations cut in half, provincial governments now have significantly fewer nominations available for employer-sponsored applications. This affects:

Skilled trades recruitment: Provinces typically reserved large PNP portions for construction, manufacturing, and technical roles

Regional hiring strategies: Smaller provinces that relied heavily on PNP to attract talent now face severe constraints

Processing timelines: With fewer spots available, competition increases and processing times may extend

International Student Pipeline Disruption

The 50% reduction in international students creates immediate challenges for employers who have historically recruited from post-graduation work permit holders. Industries particularly affected include:

Technology and software development

Healthcare and life sciences

Hospitality and food services

Retail and customer service

Temporary Foreign Worker Constraints

The 50% reduction in temporary foreign worker admissions directly impacts seasonal and cyclical industries:

Agriculture and food processing

Construction and infrastructure projects

Tourism and hospitality

Transportation and logistics

Strategic Workforce Planning: Your 5-Point Action Plan

1. Audit Your Current Immigration Dependencies

Immediate Action: Analyze what percentage of your workforce planning relied on immigration channels. Identify roles, departments, and seasonal needs that will be most affected by these cuts.

Key Questions to Answer:

How many positions did you fill through PNP nominations in 2024?

What percentage of your recent hires were international students or temporary residents?

Which roles will be hardest to fill domestically?

2. Prioritize Permanent Residency for Existing Employees

Strategic Advantage: The new immigration plan gives priority to people already in Canada. More than 40% of 2025 permanent residence targets will be filled by existing temporary residents.

Action Steps:

Identify temporary employees, international students, or work permit holders on your team

Fast-track their permanent residency applications through available programs

Consider providing immigration legal support as an employee benefit

3. Invest Heavily in Domestic Talent Development

With tighter immigration channels, domestic talent becomes exponentially more valuable.

Proven Strategies:

Partner with local colleges and universities for co-op and apprenticeship programs

Create internal training programs to upskill existing employees

Offer competitive compensation packages that reflect the tighter labor market

Develop remote work policies to access talent from across Canada

4. Optimize Your Remaining Immigration Opportunities

PNP Strategy: With 50% fewer nominations, your applications must be stronger and more strategic. Work closely with provincial immigration officials and ensure your business case clearly demonstrates economic benefit.

Express Entry Focus: While PNP spots decreased, Express Entry continues operating. Consider how your job offers can support candidates' Comprehensive Ranking System scores.

International Mobility Program: Explore LMIA-exempt work permits through international agreements (NAFTA/USMCA, CETA, etc.) for specialized roles.

5. Plan for Extended Recruitment Timelines

Reality Check: With reduced immigration streams, finding qualified candidates will take longer. Build this into your business planning.

Practical Adjustments:

Start recruitment processes 3-6 months earlier than previously required

Develop interim staffing solutions for critical roles

Create succession planning for key positions

Consider contract or consulting arrangements for specialized expertise

Industry-Specific Implications

Technology Sector

The 50% reduction in international students particularly impacts tech companies that have relied on computer science and engineering graduates. Consider expanding partnerships with domestic universities and investing in coding bootcamps.

Healthcare

With ongoing shortages, healthcare employers should prioritize permanent residency applications for existing internationally trained healthcare workers and explore bridging programs for credential recognition.

Skilled Trades

The construction and manufacturing sectors face dual challenges: reduced PNP allocations and tighter temporary foreign worker admissions. Focus on apprenticeship programs and domestic training initiatives.

Agriculture and Food Processing

Seasonal employers should plan for significant workforce constraints and may need to invest in automation or restructure operations to reduce labor dependencies.

What the Numbers Really Mean Long-Term

Canada is shifting from a rapid population growth model (450,000-500,000 permanent residents annually in 2023-2024) back to more historical levels. This represents a 20% reduction in permanent immigration and much larger cuts to temporary programs.

For Employers, This Means:

Higher competition for available talent

Increased importance of employee retention

Greater emphasis on productivity and efficiency

Potential for higher wage growth in skilled occupations

Early Indicators and Market Response

Despite the significant cuts, early reports suggest corporate immigration operations have remained relatively stable through the transition. However, employers should expect:

Longer processing times for immigration applications

Increased competition for PNP nominations

Higher legal and consulting costs for immigration services

Greater emphasis on demonstrating genuine job market need

Your Next Steps

The immigration landscape has fundamentally changed. Employers who adapt quickly will maintain competitive advantage, while those who delay risk significant talent acquisition challenges.

Immediate Actions:

Assess your current workforce and identify immigration-dependent roles

Fast-track permanent residency applications for existing temporary employees

Develop domestic talent acquisition strategies

Build relationships with local educational institutions

Consider consulting with immigration legal experts to optimize your remaining immigration opportunities

Long-term Planning:

Invest in employee development and retention programs

Explore automation for roles facing acute shortages

Develop remote work policies to access broader talent pools

Create competitive compensation packages reflecting tighter labor markets

The immigration cuts are substantial and permanent. But employers who understand the new landscape and adapt their strategies accordingly will find opportunities to build stronger, more resilient workforces.

Ready to develop your workforce strategy for Canada's new immigration reality? Book a consultation to discuss how these changes affect your specific industry and hiring needs.

Comments